Many former bank savers, disgusted by the near zero rates offered on their savings by banks, have increasingly turned to bond funds as a means of harvesting interest income.

Since 2008, when the Federal Reserve decided to force interest rates to unprecedented lows, investors have poured a staggering $1 trillion into bond funds. Will 2013 be the year that financially ruins bond investors? Accordingly to Bill Gross, the “Bond King” who manages the largest bond funds in the country, wild money printing by the Federal Reserve and trillion dollar deficits could lead to higher inflation and interest rates, in which case “bonds would be burned to a crisp”. Not exactly a comforting thought coming from the head man at Pimco, who has consistently outperformed other bond funds.

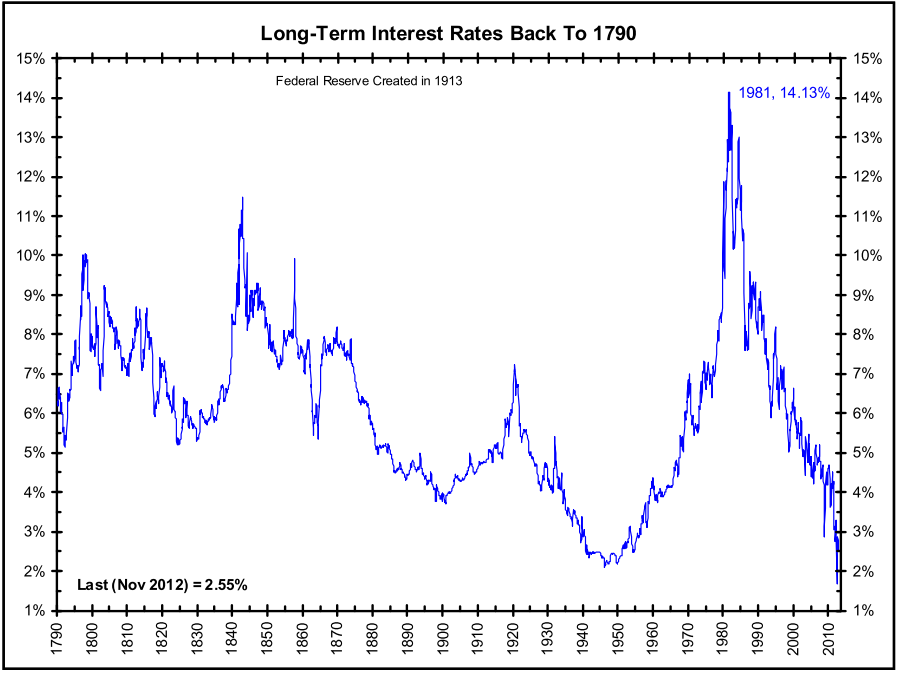

I doubt if the average bond investor is paying much attention to the warning from Bill Gross. Rear view mirror investing seems to be the predominant trait among all investors and in the case of bonds, it has actually paid to invest on this basis. Bonds have been in a virtually uninterrupted bull market for over the past thirty years since long term interest rates peaked at 14% in the early 1980’s. Over the past three decades, bond investors have enjoyed not only a steady stream of interest income but also capital gains as the value of bonds increased.

Long forgotten by most of today’s bond investors is the ugly performance by bonds before 1980. The current 30 year bull market in bonds was preceded by a 30 years bear market which started in 1950. Rates continually increased, driving bond prices lower until bonds were universally proclaimed to be “certificates of confiscation.”

Courtesy: thebigpicture.com

With yield on long term bonds reaching lows never seen before in the past 200 years, bond investors remain remarkably complacent. Worst of all, that complacency may be due to a total lack of understanding regarding the relationship between interest rates and bond prices.

Here are three basic questions for bond holders to ponder, all of which relate to the risks of owning a bond fund. If you don’t know the answers without having to do a Google search, you probably shouldn’t be in a bond fund. If you can’t understand the answers after doing a Google search, you definitely shouldn’t be in a bond fund.

1. What does “duration” mean and what is the duration of the bond fund that I own?

2. What type of bonds does my fund hold and what is the credit quality of those bonds?

3. What does it mean when I hear that “there is an inverse relationship between interest rates and bond prices?”

Speak Your Mind