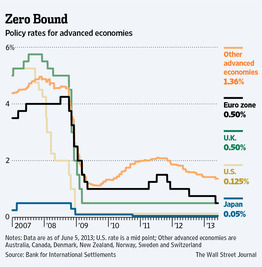

In response to the financial crisis, massive debt burdens and slow economic growth since 2008, the world’s central banks have engaged in unprecedented monetary intervention. Short term interest rates have been suppressed by to levels barely above zero and central banks have purchased trillions of dollars of government debt securities to finance governments already staggering under huge debts.

In response to the financial crisis, massive debt burdens and slow economic growth since 2008, the world’s central banks have engaged in unprecedented monetary intervention. Short term interest rates have been suppressed by to levels barely above zero and central banks have purchased trillions of dollars of government debt securities to finance governments already staggering under huge debts.

While the zero interest rate policies (ZIRP) of central banks have allowed the world economy and banking systems to stabilize, the recovery from the deep recession of 2008 is the slowest on record of all post war recessions. The question that keeps central bankers up at night is what measures would be necessary or feasible if their is another financial crisis.

The cheap money policies of central banks only works in limited ways and entails unintended adverse consequences. No less an authority than the Bank for International Settlements, (BIS) which is effectively the world central bank, warned this week that central banks have a limited ability to return sluggish economies to sustainable and strong growth.

In addition, Stephen Cecchetti, head economist at BIS warned that “So far, continued low interest rates and unconventional monetary policies have made it easy for the private sector to postpone deleveraging, easy for the government to finance deficits, and easy for the authorities to delay needed reforms in the real economy and in the financial system.” The BIS also noted that central banks have taken on roles far removed from their basic mandates of low inflation and stable financial markets.

Courtesy: wsj.com

Central banks have not only repressed interest rates but have also purchased $10 trillion dollars of government debt securities to re-inflate asset values such as stocks, bonds, and real estate. Unwinding these huge purchases that are on the balance sheets of central banks entails major risks such as crashes in stock and bond markets.

The BIS also defended austerity measures noting that numerous studies have shown that countries with a debt to GDP ratio above 90% are doomed to a prolonged period of economic weakness.

The central banks of the world have done their job for now by preventing a depression that would have made the 1930’s look like a picnic. How well the central banks can contain a future financial crisis remains to be seen.

Speak Your Mind