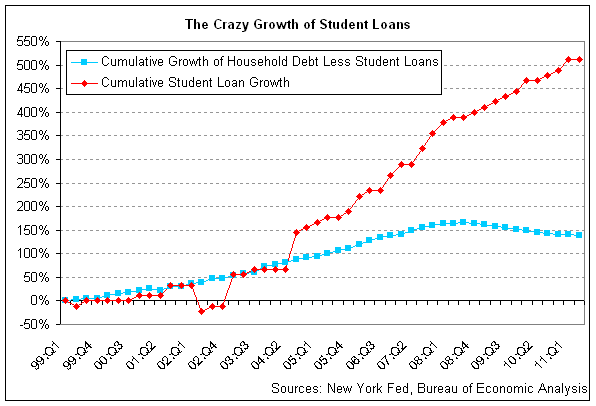

The mantra of “go to college, graduate and get a good paying job” has lured countless numbers of young Americans into borrowing ridiculous amounts of money to attend college. Borrowing money to invest in education becomes a specious theory when a majority of graduating students wind up being unable to find a job or are forced to accept a job that pays little and has no correlation to their field of study.

A cruel joke indeed, but hapless students continue to borrow at a frenzied pace without considering if the costly degree will ever generate the income needed to pay off the cost of the education.

Making matters even worse, college graduates who can’t make their monthly student loan payments are dragging their aging parents into the same debt trap that they have fallen into due to the fact that many parents co-signed for their children’s student loans. This New Peril for Parents comes as a shock to many parents who never took the time to fully understand that co-signors are jointly liable for debts.

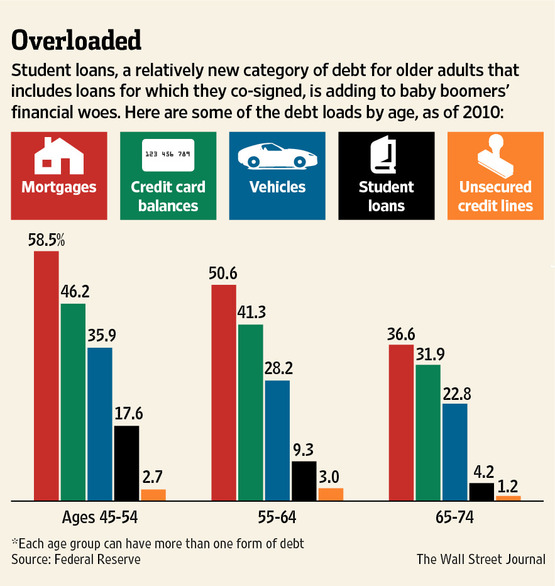

After years of facing all sorts of financial pressures they never expected, from adult kids moving back home to their own parents needing help to retire, empty nest parents are struggling with a new headache. Thinking it was only natural to want to help children and grandchildren, many co-signed student loans. Now, they’re becoming the latest victims of the nation’s mounting problem with student-loan debt, which surpassed the $1 trillion mark last year.

At a growing rate, young graduates who are either out of work or who didn’t land high-paying jobs find themselves unable to pay their loans. When primary borrowers stop paying, co-signers are expected to pick up the tab—and soon find themselves fending off debt collectors. “People are confused about what it means to co-sign, and their ongoing obligation,” says Deanne Loonin, director of the Student Loan Borrower Assistance Project at the National Consumer Law Center, a consumer-advocacy group in Boston. “When they come to understand that they are equally liable, the regrets set in.”

According to the Federal Reserve Bank of New York, some 2.2 million Americans who were 60 or older owed $43 billion in federal and private student loans at the end of the first quarter this year, up from $15 billion in 2007, just before the financial crisis erupted. The figures include loans made to parents as well as those for which older adults have co-signed.

About 9.5% of loan balances owed by Americans at least 60 years old were at least 90 days delinquent at the end of March, up from 7.4% at the same time five years ago, according to the New York Fed. For 50- to 59-year-olds, the numbers are rising almost identically.

For co-signers, the consequences of not paying are severe. Defaulted loans show up on their credit reports as if the debt were their own. Even when loans are current, the added debt can make it tougher for co-signers to qualify for mortgage refinancing or other loans. Faced with the question of whether to pay or not, many older people say they see simply no alternative but to dig deep into savings or tap retirement accounts to fulfill their obligations.

Courtesy: Wall Street Journal

Debt that cannot be repaid won’t be repaid and at some point, Uncle Same is going to be looking at huge losses as both borrowers and co-signors default. The entire system needs to be reformed starting with a cold assessment of the correlation between the cost of a degree and future earnings capacity. In an age of wage globalization and an endless recession, it can no longer be assumed that a college degree is the ticket for a good paying job. If someone can’t figure out that equation, they probable shouldn’t consider college in the first place.

My husband and I co-signed on several loans to help our son go to college. After college he went into the army and came home a Captain with many awards such as a Bronze Star, and an emotional mess. Apparently he was in a building with his men that was blown up and the blew body fluids of his men down his throat among. He was not physically hurt. He has not been able to find a job. It is going on 5 years now I think. We do not know where he is and have not heard from him in quite some time. He refused any suggestion to go out to the VA for help. My husband and I are older. My husband is getting ready to turn 81 and we keep paying the bare min. to Sallie Mae and Citibank on co-signed loans. The phone rings at least 12 times a day from them wanting more money. When we have extra we send it but they don’t seem to care. We don’t know what to do. It is so frustrating and it makes us angry that our country could bail out banks and not help their elderly.