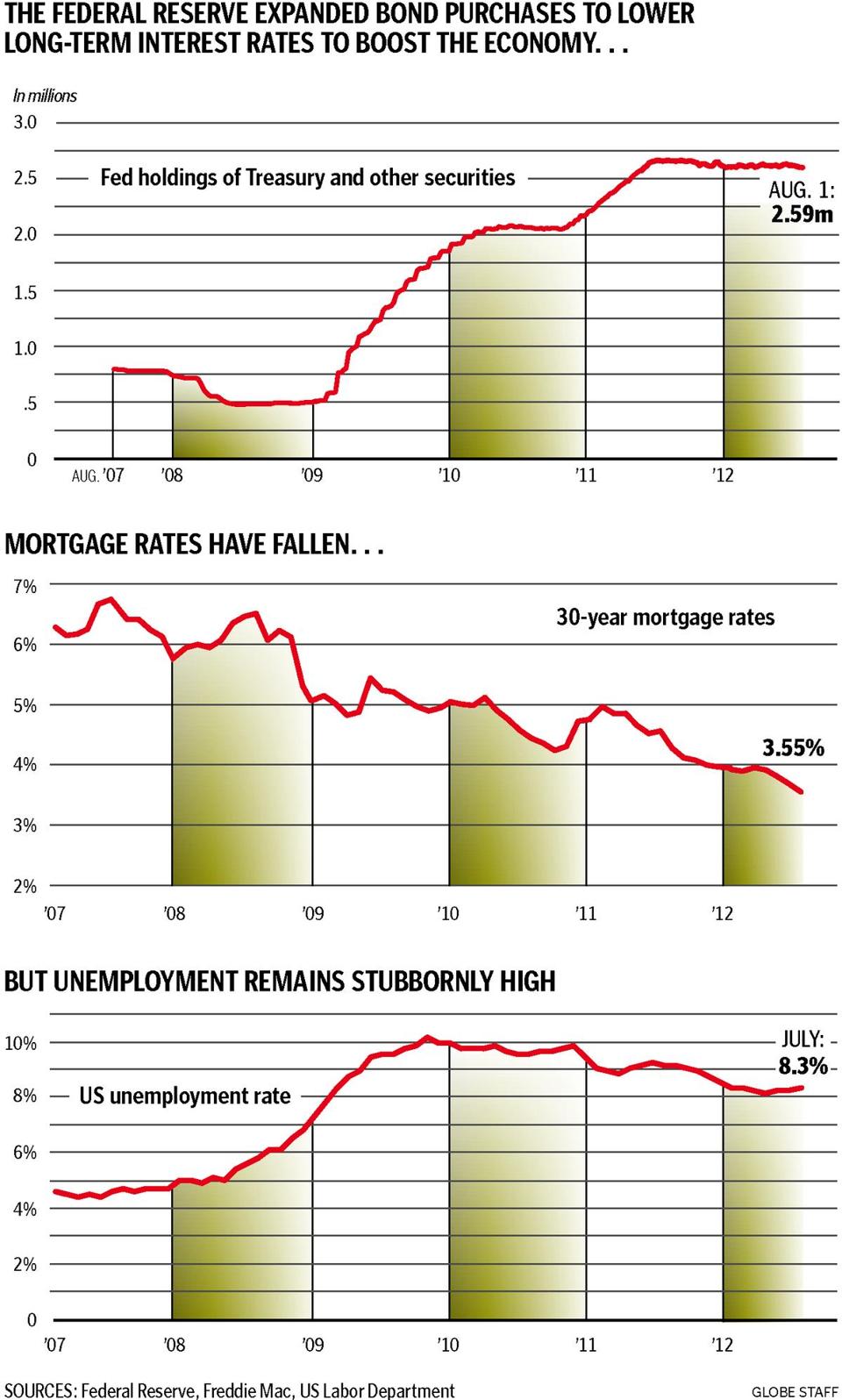

The Federal Reserve’s policy of printing money and repressing interest rates to all time historical lows was supposed to result in widespread economic benefits. The results to date, however, have proven uneven. While homeowners have reaped the benefit of lower mortgage rates, savers and retirees have experienced real negative returns, which has resulted in a zero sum game for consumers according to Mortgaged Future.

Exactly how much lower the Fed intends to repress mortgage rates is anyone’s guess but as interest continue to decline, the overall benefits diminish. Here’s three reasons why the Fed may wind up discovering that the economic benefits of further rate cuts will be muted at best, self defeating at worst.

1. Lower rates are becoming a zero sum game for the economy as lower rates for borrowers translates into lower income for savers. Every loan is also an asset of someone else and lower interest rates have merely been a mechanism for transferring wealth from savers to debtors. Every retiree who prudently saved with the expectation of receiving interest income on their savings have been brutalized by the Fed’s financial repression. Even more infuriating to some savers is the fact that many debtors who took on irresponsible amounts of debt are now actually profiting from various government programs (see Foreclosure Settlement Q&A – A Victory For The Irresponsible).

A significant number of retirees that I know have been forced to drastically curtail their spending in order to make ends meet while others have been forced to draw down their savings. The increased spending power of borrowers has been negated by the reduced spending power of savers. This fact seems to elude Professor Bernanke who hasn’t been able to figure out why lower rates have not ignited the economy.

2. Many consumer who would like to incur more debt are often turned down by the banks since their debt levels are already too high. Those who can borrow often times chose to deleverage instead, considering the fragile state of the economy. Anyone saving for a future financial goal (college tuition, home down payment, retirement, etc) is forced to reduce consumption and increase savings due to near zero interest rates. The Federal Reserve has destroyed Americans most powerful wealth building technique – the power of compound interest. A 5% yield on savings will double your money in about 14.4 years while a 1% yield will double your money in 72 years – and that’s before taxes and inflation.

3. As mortgage rates decline into uncharted territory, the mathematical benefit of lower rates diminishes. As can be seen in the chart below the absolute dollar amount of monthly savings as well as the percentage decrease in the monthly payment diminish as rates race to zero.

Will the Federal Reserve continue to obsessively pursue a zero interest rate policy and, if so, will it wind up doing more harm than good? A recent article in the Boston Globe argues that with rates already at near zero, the benefit of additional stimulus will be limited.

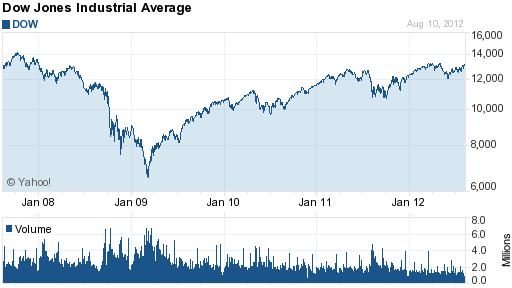

The clear cut winners of the Fed’s unprecedented money printing campaign and repression of interest rates has been corporate American which has seen profits surge to almost all time highs. In turn, investors in stocks have reaped huge gains as prices have recovered almost all of the losses from the crash of 2008.

Courtesy - chartoftheday.com

courtesy yahoo finance

The trickle down benefits to consumers has been relatively restrained with unemployment at recession levels. In addition, housing remains flat on its back with prices at levels last seen a decade ago and real consumer income and purchasing power has declined. Retirees and savers have been crushed financially as their interest income has been virtually wiped out. Yet, the Fed’s Chairman, who has clearly run out of options promises to continue on the same policy path which has clearly produced very lopsided results. While Wall Street continues to cheer Fed policies, the average consumer has little reason to believe that Fed policies have been beneficial.

Speak Your Mind