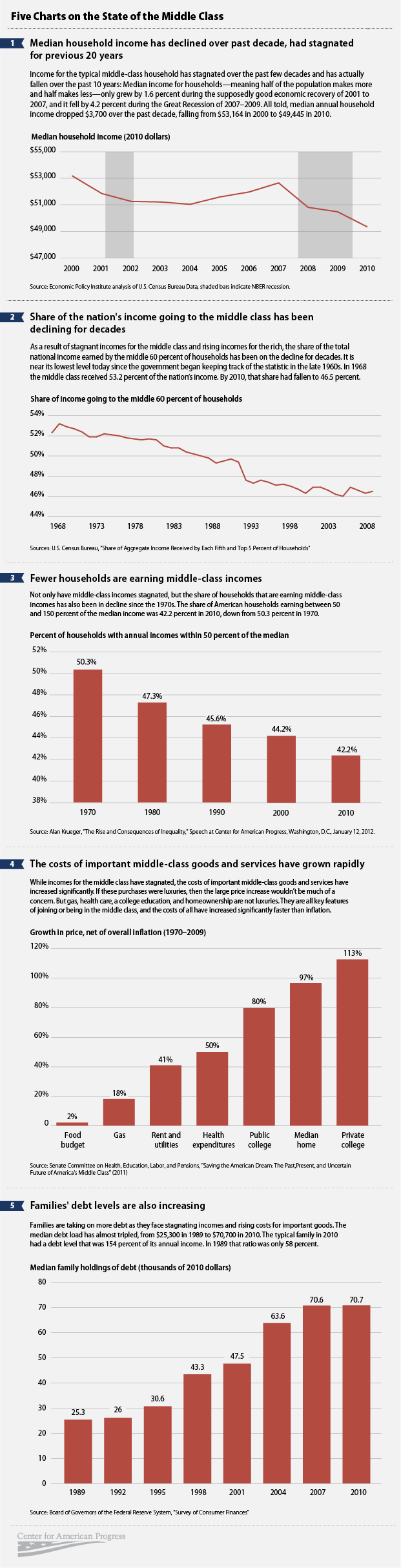

No one likes earning less this year than last year. If the weekly paycheck is a scoreboard on how well we are doing – then we are all in deep trouble. The Center for American Progress recently published some shocking charts that portray the American middle class besieged by lower income, higher costs for essential goods and services and rising debt levels.

None of this is news to the average American family. The struggle to stay one step ahead of creditors has become more and more difficult. As incomes have decreased, Americans have been forced to mortgage their future by increasing debt levels. The end game to this scenario is something we should all be thinking about. Exactly what happens when families reach the limits of their borrowing capacity even as incomes continue to decline?

Courtesy: americanprogress.org

Unfortunately, there are no magic solutions to the vanishing paycheck, increased debts and higher living costs. Expecting the government to fix things? Politicians who say they have a “magic solution” are engaging in the worst form of vote pandering. Logically, if they had solutions, don’t you think they would have implemented them?

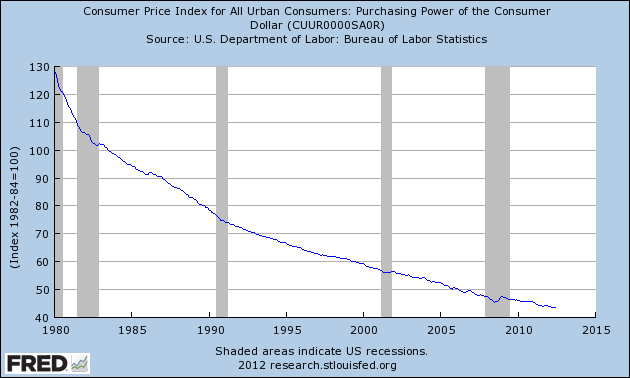

What about the all powerful Federal Reserve? If they saved us from financial collapse in 2008, why can’t they fix things now? Despite all the talk about the Federal Reserve coming to the rescue, the plain fact is that the Federal Reserve can’t produce the basic things we need such as jobs, oil or food. The Federal Reserve is good at only one thing – producing oceans of dollar bills which are quickly becoming worth less and less. Here’s a chart from the Fed’s own website which shows how the purchasing power of the dollar has collapsed since1980.

Still think the Fed or the politicians will rescue us? Don’t hold your breath.

Speak Your Mind