Carmen Reinhart and Kenneth Rogoff, in their best selling book, This Time Is Different, have examined sovereign debt defaults over the past eight centuries from around the globe. Based on their in depth analytical studies, the authors conclude that large scale financial crises such as 2008 inevitably lead to ruinous increases in government borrowing and decreased tax revenues. Recoveries from major financial busts are extremely protracted, leading to both higher inflation and national debt crises (think Europe today, U.S. tomorrow).

Making matters even worse, Reinhart and Rogoff show that increased government borrowings, done in an attempt to “stimulate” economic growth, actually wind up suffocating the economy under the burden of unsustainable debts. Some very dense analytical work backs up the assertions of Reinhart and Rogoff but the ultimate common sense conclusion is obvious to most people – borrow more than you can ever expect to repay and default becomes inevitable. In the case of governments, whose central banks can print money at will unlimited amounts of money to avoid a “technical default”, the ultimate outcome of higher inflation results in wiping out the wealth of a nation’s middle class.

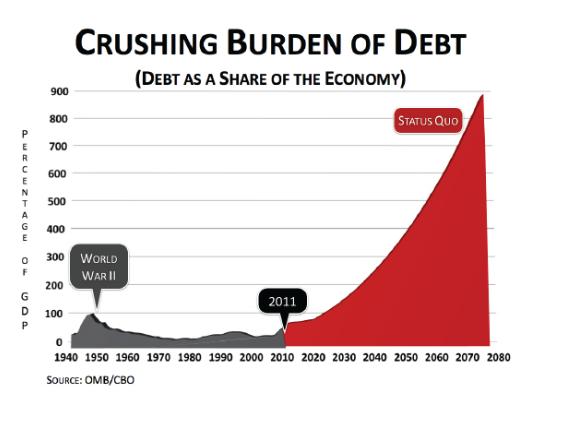

Courtesy: mygovcost.org

Not surprisingly, in a study of the relationship between debt and GDP growth, European Central Bank researchers have come up with the same conclusions as Reinhart and Carmen. The ECB study shows that massive increases in government debt, meant to “stimulate economic growth” ultimately wind up choking a nation’s economic growth. This from Bloomberg:

Governments of the euro countries begin hurting their economies with every euro of spending that pushes their debt beyond 95 percent of gross domestic product, say European Central Bank researchers.

In a study of the relationship between public debt and economic growth in a dozen euro nations between 1990 and 2010, Anja Baum, Cristina Checherita-Westphal and Philipp Rother found increasing public debt for short periods can boost expansion. The effect ends when debt reaches about 67 percent of GDP and becomes negative as debt approaches 95 percent of GDP.

The paper serves as a rejoinder to economists who have argued cash-strapped economies with debt as high as 160 percent of GDP in Greece should still try to stimulate their way out of recession.

“The short-term economic stimulus from additional debt decreases drastically when the initial debt level is high and might even become negative,” the authors said in a working paper released this month. “In light of the attempt to defend increasing debt with economic stimulus reasons, our results are supportive only if the initial debt level is below a certain threshold.”

Belgium, Ireland, Greece, Italy and Portugal are all projected by the European Commission to run debt beyond the 95 percent level this year.

So where does this all wind up? Can politicians man up and admit to the public that we have reached the limits on our nation’s ability to mortgage our future? Will politicians take responsible measures to slowly restore the financial integrity of the U.S. financial system by admitting to voters that massive entitlement promises have become mathematically impossible to keep?

Not likely since this is the point at which the self destructive nature of democracy comes into play. Politicians who have the courage to speak the truth will be voted out in favor of those who continue to tell the American public “sweet little lies.” The long term outlook is bleak since we have mortgaged the future of our children and grandchildren under the misguided notion that debt does not matter.

Speak Your Mind