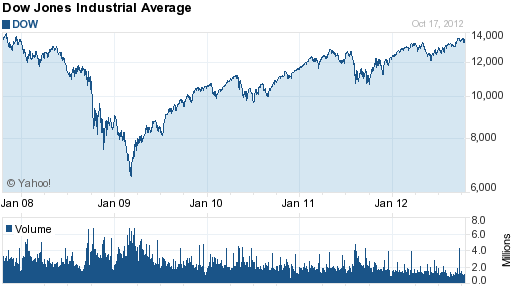

Sell in panic and repent in leisure. I have stopped trying to keep track of the number of people who have related to me that they will never buy stocks again after getting decimated in the financial panic crash of 2008. From a peak of 14,164 on October 9, 2007, the Dow Jones crashed by over 50% to under 7,000 in early 2009. The financial system came close to a complete meltdown before the Federal Reserve stabilized the economy with a massive injection of liquidity and bailouts.

Courtesy yahoo finance

Many middle income investors, some ready for retirement, panicked and sold at the worst possible time to preserve what was left of their life savings. Given the dire predictions of economic Armageddon that were prevalent at the time, cutting your losses seemed like the wise thing to do.

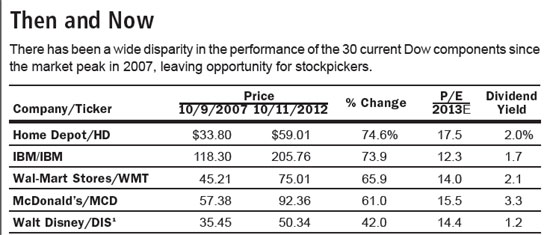

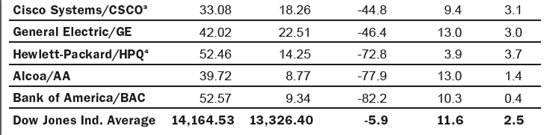

In a remarkable turnaround, the Dow Jones is now within striking distance of its all time high hit in 2007. Do those who remained in the market have anything to cheer about? Investors with a diversified stock portfolio did well by avoiding panic selling . On the other hand, investors heavily invested in a small number of under-performing Dow stocks have little to cheer about. As the chart below shows, the top five Dow performers are up 42% to 75% from their 2007 peak while the five worst Dow stocks are 45% to 82% lower.

Source: Barrons

Speak Your Mind