Investing in stocks used to be an affirmation of faith in the American system of free enterprise and a method to build personal wealth. How many stories have you heard about the secretary at McDonalds or Merck or another great American company who retired as a millionaire after buying shares in the company over many years.

Have Americans lost their long term perspective and faith in the ability of America to continue to grow and prosper? Personally, I can’t imagine that a great American company such as Starbucks, Google or Chipotle Mexican Grill will not continue to prosper and greatly increase their earnings over the coming decades. As a shareholder in a successful company, you would expect financial returns to greatly exceed the return on “dumb” money kept in bank savings accounts.

Over the past five years, even as the stock market has recovered to almost new highs, Americans have consistently reduced their investments in common stocks. At the same time, public investment in bond funds (which offer pitifully low yields) has continually increased as the public seeks the “safety” of government or corporate bonds.

The most obvious explanation for the public aversion to common stocks is due to the extraordinary stock market crash of 2008-2009 which seems to have destroyed investor confidence in long term investing. Many people who had large allocations of their wealth in stocks going into 2008 got their faces ripped off in the ensuing financial crisis. Even worse, at a certain point, the tolerance for financial pain becomes unbearable as you watch your net worth decline on a daily basis during a market sell off. The end result was that many investors wound up selling at the bottom and never got back in. For retirees, this scenario proved catastrophic resulting in the need for many people to continue working well past the normal retirement age of 65.

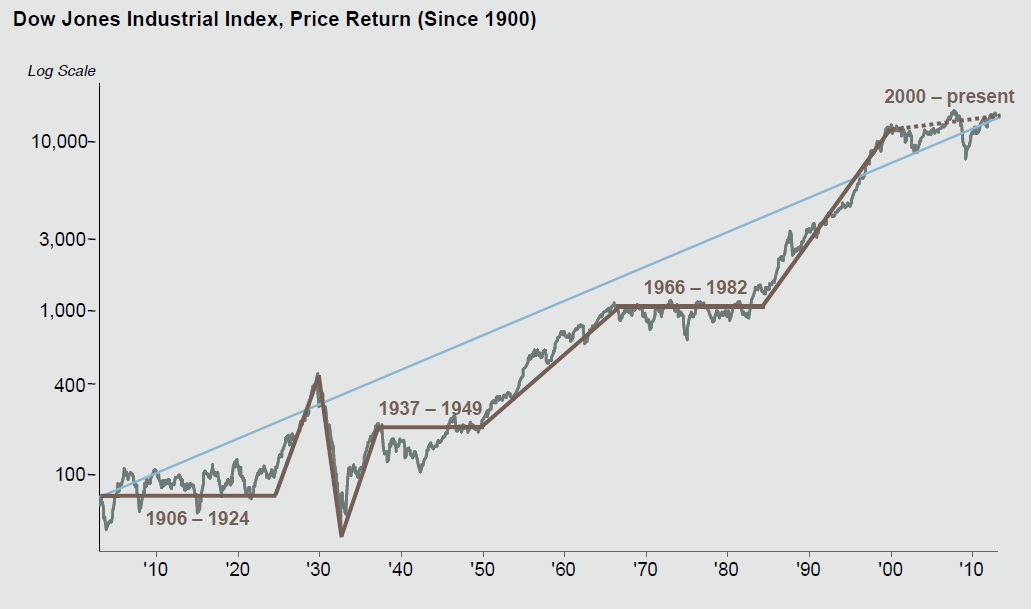

A quick glance at the chart of the market since 2002 shows the incredibly volatility over the past decade. The problem is, many retired people don’t have decades remaining to wait and hope that a collapsed stock market will someday recover – we have expenses to pay in the here and now.

Does it still make sense to invest in America through the purchase of common stocks, especially if you are still young? What do you think??

Source: JP Morgan Guide to the Markets

Speak Your Mind