By: Axel Merk and Yuan Fang, Merk Investments The concern over rising interest rates has become a primary issue with investors. While few assets are immuneto rising rates the bond market may be particularly vulnerable. The headwinds may be exacerbated by changing fundamentals in the U.S. bond market, specifically growing concentration, extended duration and changing […]

Confidence In Central Banks Collapsing – The Next Financial Crisis Could Spin Out Of Control

In response to the financial crisis, massive debt burdens and slow economic growth since 2008, the world’s central banks have engaged in unprecedented monetary intervention. Short term interest rates have been suppressed by to levels barely above zero and central banks have purchased trillions of dollars of government debt securities to finance governments already staggering […]

Homes Are Illiquid And Ridiculously Costly To Sell

When home values were soaring during the housing boom, the cost of selling a home didn’t really bother many sellers. The numerous fees involved when selling a home seemed inconsequential as home values soared year after year during those wonderful housing bubble years. That was then and this is now. With housing prices in many […]

Bonds Are Crashing – Where Can An Investor Hide?

By Axel Merk Induced by “taper talk,” volatility in the bond market has been surging of late. Is there a bond bubble? Is it bursting? And if so, what are investors to do, as complacency might be financially hazardous. Bond bubble indicator on red alert Our internal best bubble indicator is triggered when an asset, […]

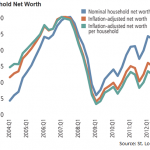

If You’re Feeling Poorer That’s Because You Are – Net Worth Plunges For Average American

In April the Federal Reserve Bank of San Francisco released a report showing that the overall net worth and value of financial assets had completely recovered from the financial collapse of 2008-2009. Since the low point of the recession in early 2009 the net worth of Americans has increased by a massive $14.7 trillion and […]

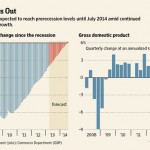

Missing Jobs and Miserable Lives

The great financial crash of 2008 resulted in over eight million jobs disappearing in a little over a year. As orders evaporated and sales plunged, companies quickly slashed labor costs in order to remain profitable. Previous recessions have caused unemployment to soar but the ensuing recoveries always resulted in a strong economic rebound and the […]

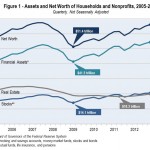

Have Your Assets and Net Worth Increased Since 2005?

Have your assets and net worth increased since 2005? According to the Federal Reserve, if your assets and net worth have not increased, you probable have a balance sheet dominated by housing, are in a lower income group, a member of a minority and have a lower than average educational attainment. As seen in the […]

10 Colleges With Horrendously Low Graduation Rates

With the cost of college outside the reach of the average middle income family, more and more people are wondering if the cost of financing college is worth the investment. We have all heard the numerous horror stories about students who graduate from college only to wind up working at low or minimum wage jobs […]

Chinese Stock Market Collapses 67% Despite Massive Stimulus Programs

The debate over whether or not government stimulus spending (financed by borrowing) is effective in reviving post crash economies rages on in the U.S. Despite the anemic economic recovery, proponents of deficit spending postulate that things would have been much worse without it. Opponents of massive deficit spending insist that the problems are merely being […]

Why The Yen Could Collapse – Japan On The Knife’s Edge

By Axel Merk Because of Japan’s massive public debt burden, pundits have called for the demise of the Japanese yen for years. Are the yen’s fortunes finally changing? Our analysis shows that the days of the yen being perceived as a safe haven may soon be over. Let us elaborate. So many foreign exchange (“FX”) […]