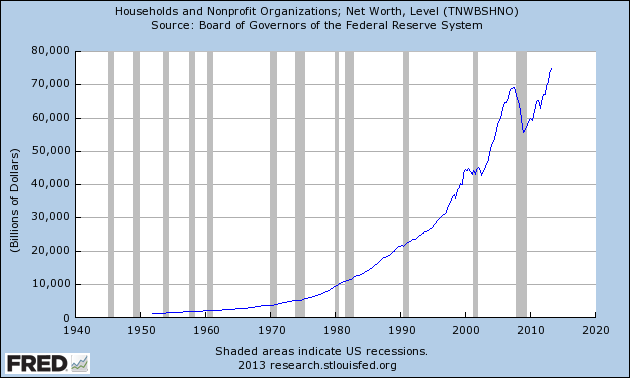

According to the latest data from the Federal Reserve, most Americans should be feeling wealthier as household net worth soared to an all time high of $74.82 trillion. This is a huge improvement from levels reached during the height of the financial crisis when household net worth plunged by almost 20% or $12 billion as stocks and real estate simultaneously crashed.

According to the latest data from the Federal Reserve, most Americans should be feeling wealthier as household net worth soared to an all time high of $74.82 trillion. This is a huge improvement from levels reached during the height of the financial crisis when household net worth plunged by almost 20% or $12 billion as stocks and real estate simultaneously crashed.

Household net worth climbed by $1.3 trillion in the second quarter propelled by a rise of $300 billion in the value of stocks and mutual funds owned by households and an increase of $525 billion in the value of real estate held.

The Federal Reserve numbers are reported in nominal dollars which are not adjusted for population growth or inflation.

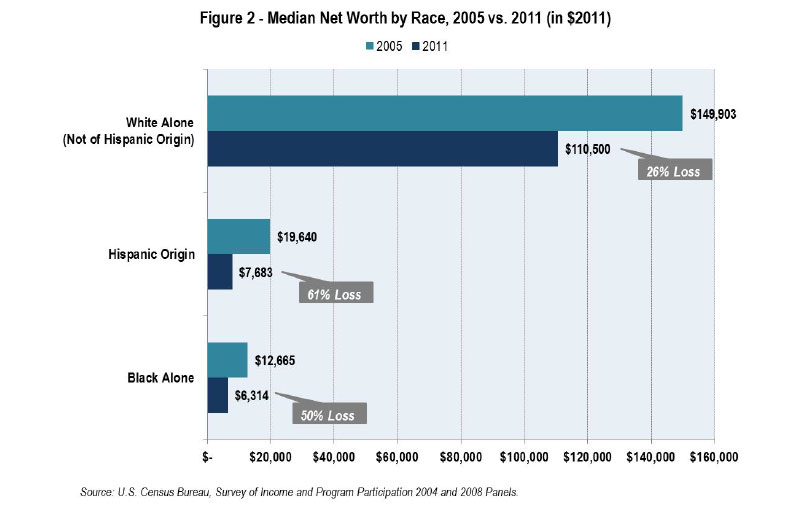

The total household net worth figures show the incredible distortion of wealth in America. If the nation’s entire net worth was divided by the number of people in the United States, every man, woman and child would be worth approximately $225,000. If you or your entire family are not worth $225,000 combined, you would find yourself in the majority class of Americans.

The median net worth of Americans averages only $110,500 for whites and a negligible $6,314 for blacks. The median is the middle of all American’s net worth arranged from smallest to largest meaning that half of all Americans have a net worth below $110,500.

Another shocking indication of the disparity of America’s wealth is shown by the fact that 59% of households headed by people 65 or older have exactly zero dollars in any type of retirement account and the average person retiring today will depend on social security payments for 70% of retirement income. Good luck living on social security payments which barely provide a subsistence level of payments.

Low-income Americans have long had to scrape by in old age, relying primarily on Social Security. The middle class, with its more educated and resourceful retirees, is supposed to be better prepared, with some even having the luxury to forge fulfilling second acts as they redefine retirement on their own terms. Or so popular culture tells us.

The reality is often quite another story. More seniors who spent much of their careers as corporate managers and professionals are competing for low-wage jobs. For these growing ranks of seniors with scant savings, it’s the end of retirement.

About 7.2 million Americans who were 65 and older were employed last year, a 67 percent increase from a decade ago, according to government data. Yet 59 percent of households headed by people 65 and older currently have no retirement account assets, according to Federal Reserve data analyzed by the National Institute on Retirement Security.

While some Americans will enjoy a prosperous retirement many others are facing a very bleak future and will have to continue working if they expect to get by.

Speak Your Mind