By Axel Merk

In our previous white paper on gold, we discussed two key reasons investors typically cite as critical decision making factors supporting an investment in gold: as a form of protection against inflation and as a safe haven investment. We showed that current dynamics may support these investment theses over the foreseeable future:

• Expectations for future inflation have become elevated, and may remain so, given a backdrop of easy monetary policies the world over.

• Continued leverage throughout the economy is contributing to uncertainty over the future trajectory of the global economy and likely to result in ongoing heightened levels of volatility.

We believe these dynamics are likely to support ongoing strength in the price of gold over the foreseeable future and consider these to be important considerations in light of the current global economy. We would also propose that an equally important, and complementary, reason for an allocation to gold is its potential portfolio diversification benefit. Indeed, we show that historically, adding a gold allocation provided substantial enhancements to a portfolio’s risk-return profile.

This white paper focuses on the portfolio applications of gold: we analyze the benefits of adding gold to an investment portfolio. Our findings show that the addition of gold into an investment portfolio may significantly improve

the overall risk-adjusted performance. Notably, gold may help to minimize downside deviations in the value of an overall portfolio, reduce overall volatility, and enhance returns. For example, in 2008, when the U.S. stock market plummeted 37.0% 2, gold actually appreciated in value during the year, returning 5.8%. Additionally, we show that low levels of correlation in movements in the price of gold relative to other asset classes is a primary factor in potentially enhancing overall portfolio performance and a key reason to consider the addition of a gold allocation. Specifically, we find that

incorporating a gold allocation into an investment portfolio produces optimal results based upon efficient frontier analysis.

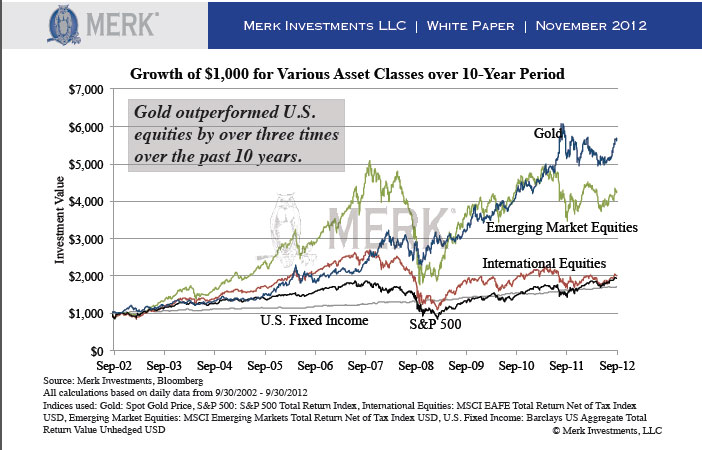

Over recent years, gold has performed remarkably well relative to other asset classes, in terms of both absolute performance and risk-adjusted performance. Over the preceding 10 years, an investment in gold would have significantly outperformed a corresponding investment in the S&P 500 Index or U.S. bonds, not to mention international and emerging market equities. Over the past 10 years, gold outperformed U.S. equities by over three times:

Speak Your Mind